In a world where the price of nothing decreases, and you sometimes find yourselves in difficult positions and struggle to get through the month with one paycheck, it is, unfortunately, a reality for many individuals.

Planning finances and managing funds effectively can help with these types of problems.

How To Plan For the Future Financially

If the management of funds isn’t the issue, maybe obtain a second source of income to secure your lifestyle and assure you never lose what you need the most – like your property or vehicles or anything contributing to your needs.

Have a look at some alternatives for when finances are tight and how we can manage it better.

Finances and planning

Without a doubt, anyone should be able to fairly and accurately predict your future expenses as well as income. This should be done every three months and should be checked monthly to ensure that your predictions are correct.

Some areas of your budget might need some fine-tuning at first, so ensure you keep your slips and calculate what you spend on a monthly basis. This should include groceries, electricity, fuel, and everything you pay monthly. Unexpected expenses will arise, so don’t be afraid of them – just plan for them!

Make sure you save some money, preferably in an alternative account, for when disaster strikes. This will be covered by your unencumbered cash and won’t affect your budget. This isn’t the only thing you need to save for – maybe open an investment that can hold money for your retirement if your employer hasn’t already done this. Treat these savings payments as an expense and not an option because you will need them.

Find a Second income

If the above is just not possible, as in many cases all over the world, you need to start with finding a second income.

It can be anything from a second job to starting something of your own. Also, a useful way of obtaining a second income is by Trading Forex, which refers to the buying, selling, and exchanging of foreign currencies at a specific rate. Some investors regularly get returns of more than 10% of their initial investment.

This can go a long way, especially if your Forex Trading income is solely used for saving, and only using it once you’re no longer able to work for a salary. You might think that it’s too little too late, but in a few years with knowledgeable trading, a small amount could accumulate to become a hefty payout.

Practice self-discipline

So in many cases, individuals start saving until the savings amount becomes slightly higher than they’re normally used to. At any cost, don’t use your retirement savings for any other purposes other than retirement.

Everyone believes they’re still young, and they will start saving for this later in life, but unfortunately, it doesn’t always pan out this way.

Many individuals realize too late in life that all the work they’ve done now suddenly doesn’t mean much. Not having savings to back you up, and, in some instances where there is no one to support you, you will not get very far, and the peaceful world you desired comes tumbling down on you.

Preparing for our old age is of the utmost importance as this is what most of us work for our entire life. Not having anything to fall back on should not be an option for anyone. So, always save and discipline yourself with your savings, as it could maybe save you a lot of trouble one day.

*****

Poetess Denise N. Fyffe is a published author of over 30 books and a publisher for Jamaica Pen Publishers.

She is a freelance writer for online publications such as Revealing the Christian Life, Jamaica Rose, Entertainment Trail, My Trending Stories among others.

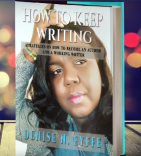

Check out her book How to Keep Writing

This book shares key practical strategies on how to become an author and a working writer. It helps you to get over the everyday nuisances that hinder the writing process. You can follow each strategy, at your own pace until you are writing frequently. It is geared towards both aspiring fiction and nonfiction authors and working writers who produce content, on a daily basis.

Available at all online book retailers and Amazon.com.

Follow her on:

Copyright © 2020, Denise N. Fyffe